4 Easy Facts About Comprehensive Car Insurance Coverage Guide - Policygenius Described

What Are the Probabilities of Filing a Comprehensive Claim? Virtually everyone goes to risk of needing to file a detailed claim - affordable auto insurance. According to Esurance, animal crashes are just one of the most usual reasons to submit a thorough insurance claim. The Insurance Policy Institute for Freeway Safety reports that there are even more than 1.

Just deer-collisions alone are accountable for even more than $1 billion in vehicle damage costs. Esurance also says if you live in a location with high prices of theft and vandalism, you may want to take into consideration thorough insurance coverage. This is especially vital if you need to park your cars and truck on the road - liability.

liability low cost cheap car low cost auto

liability low cost cheap car low cost auto

What does thorough insurance coverage cover? Comprehensive insurance policy covers damages to your vehicle that are the result of burglary, natural calamities or ordinary rotten luck. While crash protection spends for repair work to your car after a vehicle accident, essentially, comprehensive insurance safeguards your lorry while it is parked.

insurers affordable car insurance insure risks

insurers affordable car insurance insure risks

You can start contrasting cost-free car insurance coverage quotes utilizing the tool listed below. Make sure to consider plans with 2 of our top-rated providers: USAA and also State Ranch. USAA: 9. 1 out of 10. 0 In the J.D. Power 2020 United State Automobile Insurance Policy Satisfaction Research Study, USAA scored highest in every area of the U.S., suggesting that consumers are happy with their USAA protection and also solution.

8% of the insurance coverage market's consumer grievances in 2019. Simply about the only disadvantage about this company is that its vehicle insurance policies are not readily available to everybody.

Completion outcome was a general rating for each and every service provider, with the insurance companies that scored one of the most points topping the listing. Here are the aspects our ratings think about: Reputation: Our research group thought about market share, rankings from market specialists and years in service when providing this rating. Availability: Vehicle insurer with greater state schedule as well as couple of eligibility requirements racked up greatest in this category.

The Only Guide to Fully Comprehensive Car Insurance - Comparethemarket.com

Extensive insurance is a car insurance coverage that covers particular problems to your lorry that are not created by a collision with one more auto. It is needed on rented cars, and on lorries that are presently being paid for by a car loan. Thorough car insurance policy is supplementary, indicating it's an optional coverage which can be included in an insurance plan.

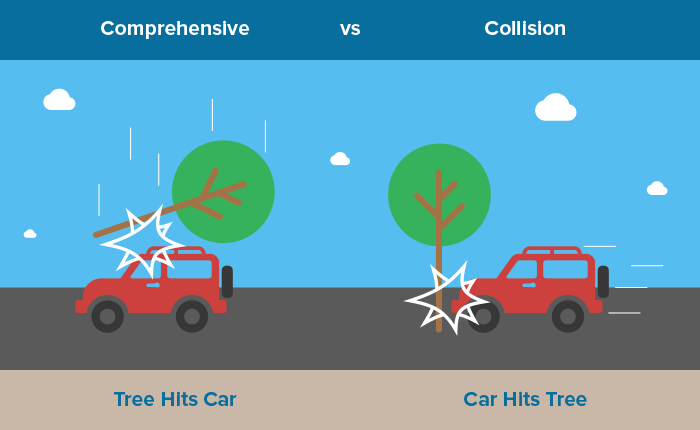

Comprehensive vs. crash insurance coverage What is detailed Visit website coverage compared to crash? Accident insurance covers you if your cars and truck is damaged by one more car, a stationary object or by rolling over. On the other hand, thorough insurance covers simply concerning whatever else.

You might state that collision is for when you hit something else, and extensive is for when something else hits you (given that another thing isn't another auto). Comprehensive vs. full coverage insurance coverage Yes - cheap auto insurance. Some people mistakenly use these terms mutually, however there is a crucial difference, particularly that many insurance coverage carriers do not offer anything called "complete insurance coverage." In other words, there is no solitary car insurance plan that covers every little thing.

Rather than having one very plan, you can pair various kinds of insurance coverage (low cost). Is detailed insurance coverage needed by law? You're not needed by regulation to have extensive insurance. That said, lending institutions will often require you to have it if your vehicle is leased or not totally repaid. 1 Detailed insurance coverage additionally covers damages from sources that are commonly past your control.

Key Insights Comprehensive insurance is to offer coverage for all the unwelcome accidents that are not covered in your standard insurance coverage. It provides coverage for the problems caused as a result of any kind of sort of man-made and all-natural calamities. Comprehensive auto insurance is advised particularly for vehicle drivers who have a cars, new cars, or financed autos.

Yes, there are some situations where no person is at mistake in a mishap however the car gets harmed. These scenarios are normally described as "poor good luck" but the repair service expense can be intolerable for the motorist. For these types of circumstances, thorough automobile insurance policy plays a major function in conserving the cash of the vehicle driver. auto insurance.

The Basic Principles Of Comprehensive Car Insurance - Car Insurance Quotes - Qbe Au

Some motorists add it to their policy even when they do not need it. On the various other hand, some avoid adding it to their plan even when they need it the most (car). Price, Pressure has created this blog to help you comprehend how thorough insurance can conserve a great deal of your cash as well as when it can be a waste of money.

It is vital to keep our cars covered from all the additional expenditures. What does extensive cars and truck insurance coverage not cover? Currently comes an interesting area, we understand what extensive insurance covers. It is additionally vital to recognize what it does not cover to stay clear of complication in the future.

Just how much is comprehensive vehicle insurance cost? Now that you have determined to add comprehensive insurance coverage to your plan it's time to inspect what will be the cost of thorough automobile insurance policy protection?

: What It Is as well as Just how It Functions? Various other than that, there are a lot of other variables that impact the cars and truck insurance policy price for any kind of motorist (cheap car insurance). And every insurance policy business takes into consideration factors like the type of cars and truck, the age of the vehicle driver, real cash value of the cars and truck, etc.

cheapest auto insurance cheapest car cheapest auto insurance money

Do you require detailed automobile insurance policy? Extensive vehicle insurance is elective for the driver like the state's minimum need protection. Even though the insurance kind is optional, it is essential for every driver. As well as if the motorist is preparing to obtain a cars and truck from lenders or leaseholders after that extensive auto insurance policy may be obligatory (cheap car).

If you know that your vehicle's actual cost worth is lower than the insurance coverage amount you will obtain then there is no point in wasting your cash. Your insurance firm will certainly never ever pay you more than the real price value of your auto. So the initial point you have to do is check your cars and truck's actual price worth.

See This Report about Basics Of Auto Insurance - Mass.gov

The deductible quantity is typically in between $500 as well as $1500 for each motorist in all the states of our country. Let's understand this with an instance - auto. If you have accepted a deductible of $800 as well as you have sued for damage from fire. Then the insurer will deduct the $800 from your case cash and afterwards will send out the cheque.

Insurance business utilize this as their insurance coverage. A motorist who recognizes that he or she will certainly have to pay up to $800 for any type of kind of fixings will certainly drive a lot more securely. car. The chances of accidents reduce and also the business conserves cash. Just how comprehensive auto insurance policy works? It is far better to comprehend the process of comprehensive insurance policy with an instance.

The insurance coverage business will certainly pay the cost of changing the windshield however the amount will include your deductible. If your insurance deductible amount was $500, so the firm will certainly pay you $2500 for the windshield substitute.

Get cheap extensive insurance at your place. Comprehensive insurance policy vs full protection insurance policy A lot of the vehicle drivers get perplexed between comprehensive insurance policy and also full coverage insurance coverage. Full protection insurance is the mix of the state's minimum liability protection, crash insurance, and also comprehensive insurance coverage. affordable auto insurance. There are some kinds of accidents that thorough car insurance coverage does not cover.

Currently when a driver incorporates the collision, detailed, and also the minimum demands (that is compulsory for every driver) then it is called complete protection insurance coverage. On the other hand, with thorough insurance policy coverage, the chauffeur will certainly acquire only the state's minimum required insurance coverage as well as extensive vehicle insurance. The car will be covered from flooding or fire however not from the accident with one more car - credit score.

Over to you! Now we wish that this blog has assisted you to comprehend the effect and advantage of getting extensive insurance. money. Purchasing car insurance policy is not as simple as it looks when you wish to conserve some money. Either you can simply get the insurance from any type of business without your study and also pay a greater costs.

Some Of Comprehensive Car Insurance: What It Covers? Detailed Guide

Rate, Pressure is here for your aid 24/7. You can contact our group to discuss any type of inquiry or confusion (suvs). Moreover; you can compare rates from the top insurance provider in your state on our site directly.

credit score insured car insurance affordable cheapest

credit score insured car insurance affordable cheapest

What Is Comprehensive Insurance? Comprehensive insurance policy protection, additionally called "besides accident" coverage, is a car insurance insurance coverage that can help pay the prices of damage to your vehicle for non-collision relevant cases. It can aid pay for damages caused by hailstorm, burglary, fire or hitting an animal. car insured.

cheaper car insurance cheaper car low-cost auto insurance laws

cheaper car insurance cheaper car low-cost auto insurance laws

As soon as you pay that, your cars and truck insurance policy will cover the rest of your prices, up to your limit. Allow's state your automobile is harmed and also will cost $6,000 to repair, as well as your deductible is $1,000. You'll only pay out of pocket for the $1,000 deductible, and afterwards your insurer will pay the other $5,000 on your extensive claim.

Inquiries you can ask on your own to see if you need this coverage are: Does your auto lender need thorough coverage? If it's less than what you would certainly pay for your insurance coverage costs, this coverage may not be worth it.

https://www.youtube.com/embed/EEV9ekappoU

What Is the Distinction In Between Comprehensive and also Collision Insurance Coverage? It's easy to blend up thorough and collision insurance coverage. This is because both coverages secure your auto. Nevertheless, they cover various points. Crash insurance helps cover vehicle mishaps, while extensive protection is even more of a physical damages insurance. It aids spend for problems that are outside of your control.