AboutThe 6-Minute Rule for What Is Gap Insurance? - Bettenhausen Chrysler Dodge Jeep ...

New drivers are most likely to get in automobile accidents than knowledgeable drivers. Here are a couple of methods you can get gap insurance with benefits and drawbacks for each option. Buying from a Dealer, The majority of cars and truck insurance coverage specialists advise preventing buying space insurance from a vehicle dealer. It can be appealing to buy gap insurance coverage from your dealership to decrease the amount of time you go without it, however gap insurance coverage rates from a dealership can be as much as 4 times higher than car insurance provider rates.

Gap insurance coverage can run you about $20 annually on average, on top of your existing insurance coverage. You might pay about 5 percent of your yearly insurance premium for detailed and collision protection. That means that if you pay a $500 yearly premium, your space insurance could be about $25 each year.

Where and how you get gap insurance coverage can impact how much more you spend for it. The cost of your space insurance depends upon a range of aspects consisting of: Present market price of your car, Your age, State, Previous vehicle insurance coverage declares Space Insurance Limits and Exclusions, Make certain to read the great print of your space insurance terms before including it onto your existing policy.

Gap insurance coverage just covers the distinction in between what you owe on your loan and your insurance payment. Deductible, When you acquire comprehensive and accident insurance coverage, you can choose the best deductible and premium ratio for your budget. When it comes to a car mishap, space insurance will not cover your deductible.

Unknown Facts About What Is Gap Insurance & Who Needs It?

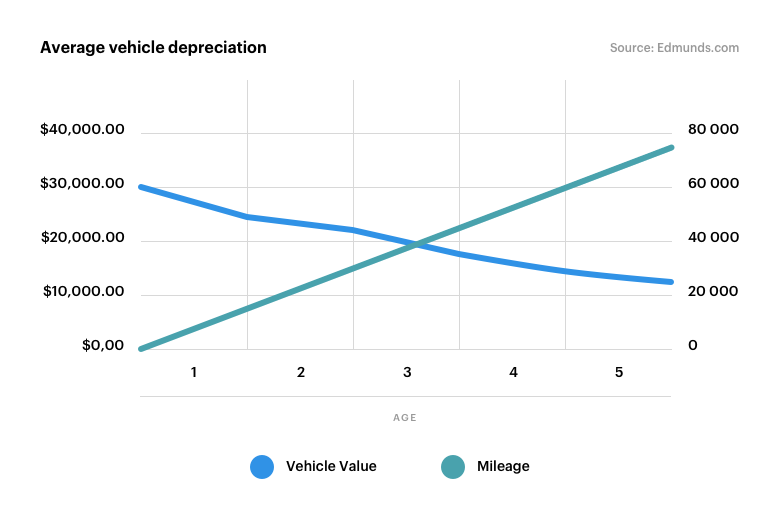

Within the very first 5 years, your automobile could depreciate by majority of its original retail worth. Space insurance won't be used unless you have an overall cars and truck loss. If you wish to safeguard yourself from any unanticipated scenarios that can leave you without a cars and truck and still owing on your loan, space insurance coverage may be the best coverage alternative.

Guaranteed Property Security (GAP) is optional inexpensive protection that supplements basic car insurance coverage to protect you versus monetary loss in the occasion your automobile is stolen or declared a total insured loss. You might think that your vehicle insurance coverage supplies all the defense that you might require if your automobile is amounted to or taken and not recuperated.

While car insurance covers the replacement value of the car, you might still be liable https://6178dced36aac.site123.me/#section-61830ab7a2e7f for the distinction between the insurance settlement and their remaining loan balance which could potentially total up to thousands of dollars. With lorry devaluation, loan terms extending, and the expense of repair work rising, chances that a "gap" will happen between the staying loan balance and insurance coverage settlement is greater than ever.

It guarantees that your vehicle loan does not end up being a financial problem in the event it is amounted to or taken. For instance, let's say you buy a new cars and truck for $35,000. We understand that the minute you drive it off the lot, the value drops. It might only be worth $27,000.

Fascination About What Is Gap Insurance? - Zeigler Chrysler Dodge Jeep Ram ...

You can compute your GAP protection by clicking here. Among the benefits of GAP is that it can assist protect you from constructing "negative equity," or debt from an old vehicle loan carried into a brand-new one. Without GAP, if your vehicle is totaled and your insurance payout does not cover the complete balance on your vehicle loan, you might have to roll the remaining balance into your next auto loan.

You are financing a new or pre-owned automobile without a large deposit, creating a "gap" between your car's real value and your loan quantity. You do not have significant cash savings that would permit you to cover the difference between the quantity you owe on your loan and the real cash value if your car is stolen or amounted to.

Find out the essentials of gap insurancewhat it is, who requires it, and how to buy it. Space insurance coverage, more precisely called space security, covers the distinction in between what you owe on your vehicle and how much the car is worth. Not everyone needs space insurance coverage (also called "totaled insurance"), nevertheless.

Before you purchase gap protection, make sure you're not already covered. It prevails for leasing business to include the coverage in the lease contract for their own security. And some car insurance policies include space protection as part of their standard coverage. Gap coverage is readily available in many, however not all, states.

The 10-Minute Rule for How Does Gap Insurance Work? - Chartway Federal Credit ...

If acquired through any source besides your insurance provider, the expense of gap protection is generally a one-time charge in the hundreds of dollars. Nevertheless, if you buy space protection from your car insurance provider, it will probably be billed as a small addition to your regular premium.

Don't forget to compute, now and then, whether you've closed the space and can forgo the extra expenditure. (To find out more about vehicle insurance, see Buying Insurance coverage for Your Automobile.) It might appear that all gap defense is the same, some items use more than others. For example, some kinds of protection reimburse your insurance coverage deductible, and some deal lorry replacement, even if the cost of the automobile has increased.

Here are other things to keep an eye out for when purchasing space security: As is constant with their prices on automobile loans, car dealerships tend to charge more for space protection than some other sources do. If you buy online, research study the vendor before sending out cash or providing personal and payment info.

What is gap insurance? If your car is amounted to in an accident, space insurance coverage assists you pay off your loan or lease, minus the deductible.

An Unbiased View of What Is The Difference Between Gap, Liability, Collision, And ...

That means if you totaled your automobile, the insurance provider would only cover the cost of its existing value. If you owe more than the worth of your vehicle's present market price, you 'd be stuck paying back any remaining balance. : Let's say you obtained $25,000 for a brand-new cars and truck.

You sue, and the insurance provider totals it out at $15,000. Problem is, your loan balance is still $20,000. What you're entrusted to is a $5,000 financing gap to settle your loan. Whether you wind up rolling this balance into a new vehicle loan or coming up with the money in some other method, being forced to pay several thousand dollars with absolutely nothing to reveal for it can be uncomfortable.

https://www.youtube.com/embed/zg3pi3kzjFQ

To comprehend why, let's take a look at why individuals have certain kinds of insurance coverage on their automobiles and when the requirements kick in. Some types of vehicle insurance coverage, specifically liability, are needed by law in many states.